The US government shutdown has lowered growth expectations for the US economy with a of cost of more than $20 billion in lost output according to some estimates, the deadlock over the debt ceiling also caused a loss of confidence in the full faith and credit of the U.S.A. And we could witness the same ordeal again in a few months. This is part of the reason the printing press is still firing on all cylinders at the Federal Reserve, and most Fed watchers now expect it to keep going until 2014. But if there is one thing that needs to be shut down in D.C. it's that very printing press aka QE now in its third round since 2009. The sooner the better. Unfortunately for the world, the only people who can make that decision are a bunch of mostly ivory tower economists, who don't understand markets, and puppets inside the Federal Open Market Committee and they don't have a good record of doing the right thing at the right time. This means this Ponzi economy can grow into larger bubbles which eventually will pop. Then central bankers of the world will be left with two words to contemplate : zero bound .

As stocks go through the roof, the main beneficiaries of this windfall are the 1% holding the lion share of stocks such as insider shareholders and company executives. Executive compensation is once again skyrocketing.

See related article : http://www.cnbc.com/id/101133032

See related article : http://www.cnbc.com/id/101133032

Meanwhile QE has done very little for the unemployed it was supposed to be helping (if you believe what Fed Chairman Ben Bernanke has been telling us for years).

The working poors don't know about QE, why they haven't seen a dollar from the printing press come their way !

One of the justifications for QE 3 which started in september 2012 was that this third round of asset purchases by the Fed ($85 billion per month of US Treasuries and mortgage-backed securities !) would lower interest rates, particularly mortgage rates, and therefore enable US homeowners to refinance, giving them more money at the end of the month to spend. On that front QE 3 clearly failed, miserably.

Mortgage rates : they rose instead, you didn't plan on that did you Ben ?

Exposing the Fed's sophisms

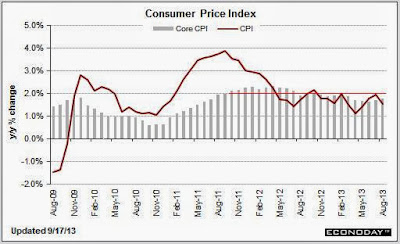

You have heard there is "no inflation". Inflation is low according to official figures, but it is simply within the range of the past decade (nonetheless depending on where you live you may have noticed prices at your local stores go up). Central bankers however are telling us inflation is too low. The chart of the CPI below shows inflation has been close to their 2% target since mid 2011. However, the Fed's preferred gauge of inflation the PCE excluding food and energy (which after all we don't consume much) remains significantly below 2%. It's pretty much within the range of the past decade but the Fed wants it to go up, up to 2,5% which means inflation including food and energy will be even higher than that. The central banks indeed want you to pay more for your every day purchases. This is all part of the obsession with the "risk of deflation" which of course remains real and ever more so as asset prices go through the roof, but Bernanke's fixation on its favorite academic subject of combating deflation is very convenient in the present circumstances as it allows the Fed to finance the US deficits while keeping the interest rate paid by the government at ultra low levels. Other central banks do the same. In doing so, central banks overlook a far greater risk to the economy : bubbles .

Consumer prices : they just never stop going up ...

This is the official inflation rate that is not quite at the target set by central bankers ...

Here is an interesting chart : one can clearly see that the core PCE - which the Fed uses because it's always lower than other measures - is not exceptionally low from a historical perspective Chart courtesy of dshort.com

Above : UK inflation rate (year-over-year). The UK also has resorted to massive quantitative easing to prop up the housing market and banks, pensioners have been the collateral damage while housing continues to inflate.

Consumer prices : they just never stop going up ...

This is the official inflation rate that is not quite at the target set by central bankers ...

Here is an interesting chart : one can clearly see that the core PCE - which the Fed uses because it's always lower than other measures - is not exceptionally low from a historical perspective Chart courtesy of dshort.com

Above : UK inflation rate (year-over-year). The UK also has resorted to massive quantitative easing to prop up the housing market and banks, pensioners have been the collateral damage while housing continues to inflate.

How central bank policies have created inflation :

Inflation, just like in 2003-2007, mainly went into assets. Of course, asset inflation isn't inflation according to central banks, it's good for the economy, it's good for the banks, it's good for corporations whose inflated stock price allow acquisitions (those often go bad later), it's good for those who own assets, whether it be stocks, real estate, art ... It's good for millionaires and billionaires. The rich get richer but according to central banks, the rich will then give to the poor when they start splurging on all kinds of things. It's a theory of central bankers called "trickle down economics".

See related article : Fed robbing poor to pay rich http://www.cnbc.com/id/101046937

House prices are rising fast again, UK house prices are at an all-time high !

Above : the Case-Shiller Index . One of the Fed's objective has definitely been met : higher house prices. In fact, they have risen rapidly in some parts of the country, causing some experts to worry about a frothy market. Combined with higher mortgage rates, this has hurt housing affordability.

Dow Jones Industrials Chart by Netdania

About the only "achievement" of the Fed's QE 3 program has been higher asset prices, stock prices have skyrocketed. Click on the chart below. It's Tesla Motors, the poster child of this new Nasdaq bubble. And there are many stock charts that look the same ... Tesla's (forward) PE : 99, the automotive company shows no net income, and negative profit margin. Facebook's stock is another product of the gigantic Ponzi scheme created by the Federal Reserve policies. Facebook 's(trailing) PE : 240.

Chart by Netdania

WTI Crude oil . The US has become the world's biggest oil producer ahead of Saudi Arabia thanks to the shale revolution. Yet prices are still elevated. There are other (geopolitical) reasons to explain that, but remember how "elevated prices"used to be justified by tight supplies and red hot growth in emerging markets ? Both of these factors are less relevant today, but oil prices remain sky high.